27.12°C Kathmandu

27.12°C KathmanduMoney

Nepse gains 18.12 points

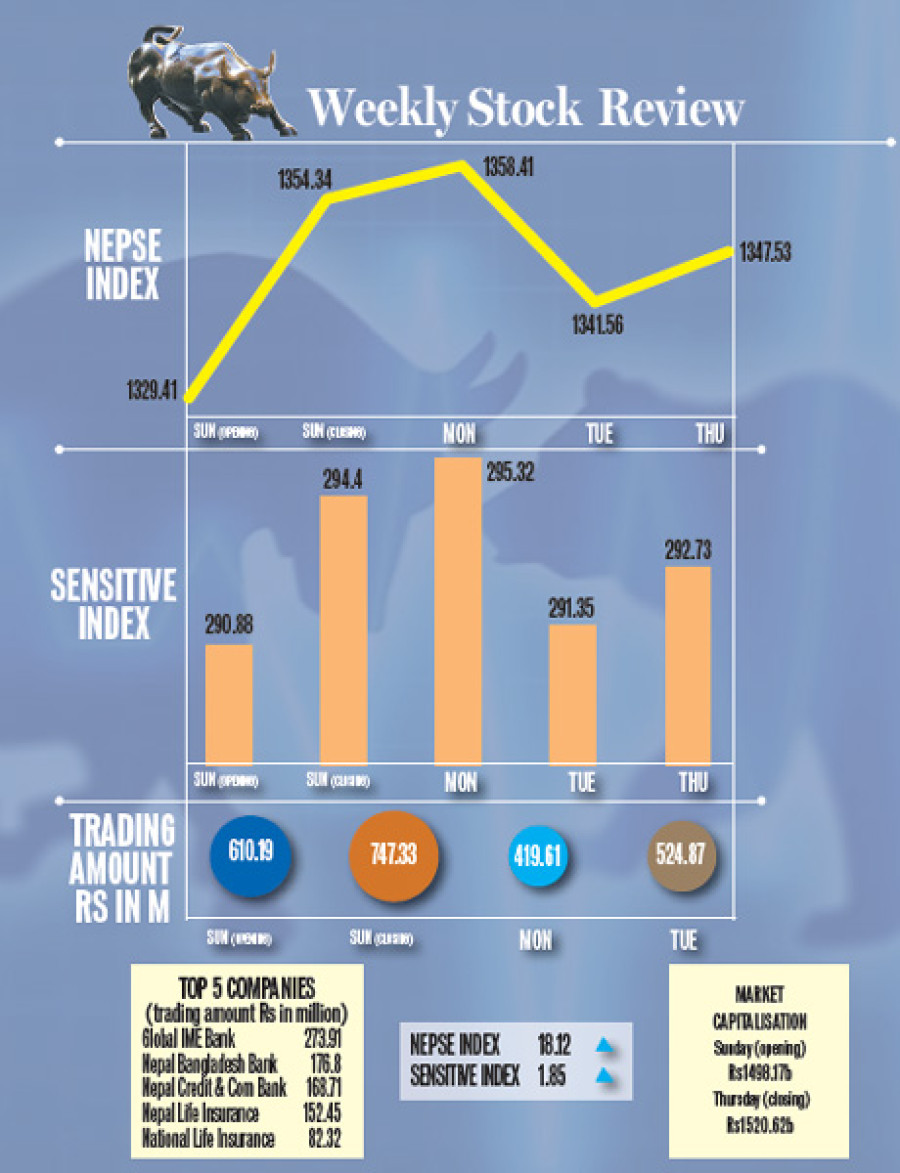

Nepal Stock Exchange (Nepse) last week rose 18.12 points to close at 1,347.53 points amid a surge in demand after investors received their money back following completion of allotment of initial public offerings and further public offerings of a number of companies.

Nepal Stock Exchange (Nepse) last week rose 18.12 points to close at 1,347.53 points amid a surge in demand after investors received their money back following completion of allotment of initial public offerings and further public offerings of a number of companies.

The market, which opened at 1,329.41 points on Sunday, gained 24.93 points to close the day at 1,354.34 points. On Monday too, index rose 4.07 points to 1,358.41 points, before losing 16.85 points on Tuesday. A 5.97-point gain on Thursday resulted in the market closing the week 1.36 percent higher.

“Investors were also attracted by cheaper share prices as the market posted losses in the previous weeks” said Anjan Raj Poudel, managing director of Thrive Brokerage House. “Also, a number of investors, who invested in primary shares, received back their money following share allotment. This led to higher demand for shares.”

Along with the Nepse index, the sensitive index that measures the performance of Group ‘A’ companies gained 1.85 points to close at 292.73 points.

The total value of shares listed on the exchange jumped by Rs22.45 billion, with the market capitalisation reaching Rs1,520.62 billion from Rs1,498.17 billion over the week.

The insurance sub-group witnessed the largest gain of 207.36 points to close at 6,089.62 points. “As the sub-index has come down significantly over the last few weeks, investors were attracted by cheaper price,” Poudel said.

The group representing hotels stood second, with the sub-index rising by 39.79 points to 1,807.17 points. Other gainers were hydropower companies (up 30.44 points) commercial banks (up 15.27 points), development banks (up 14.03 points), finance companies (up 6.03 points) and manufacturing (up 2.09 points).

The Others group was last week’s sole loser, with the sub-index declining by 2.03 points. The Trading group was stable at 206.16 points throughout the week.

Global IME Bank topped in terms of both transaction amount (Rs273.91 million) and the number of traded shares (680,000 units). “As the bank recently had its book close, announcing a 19 percent bonus shares, a large number of investors were attracted towards its shares,” Poudel added.

Nepal Bangladesh Bank came second in terms of the transaction amount—Rs176.8 million. It was followed by Nepal Credit and Commerce Bank, Nepal Life Insurance and National Life Insurance. Last week, shares of 156 listed companies were traded. The overall market transaction went up 50.15 percent to Rs2.30 billion. The number of traded shares increased to 4,576,220 units from 3,320,510 units.

Right Shares/Bonus Shares

Company Type Units

Nepal SBI Bank General 67,767

Shree Investment & Finance Bonus 231,000

Premier Insurance Bonus 747,507

United Insurance Bonus 504,000

Chhimek Laghubitta Bikas Bank Bonus 2,383,231

Shrijana Finance Bonus 1,008,000

Triveni Bikas Bank Bonus 1,558,029.04

Araniko Development Bank Bonus 438,312.11

Triveni Bikas Bank Right 4,100,076.42

United Finance Right 1,159,836

.jpg&w=300&height=200)