26.12°C Kathmandu

26.12°C KathmanduMoney

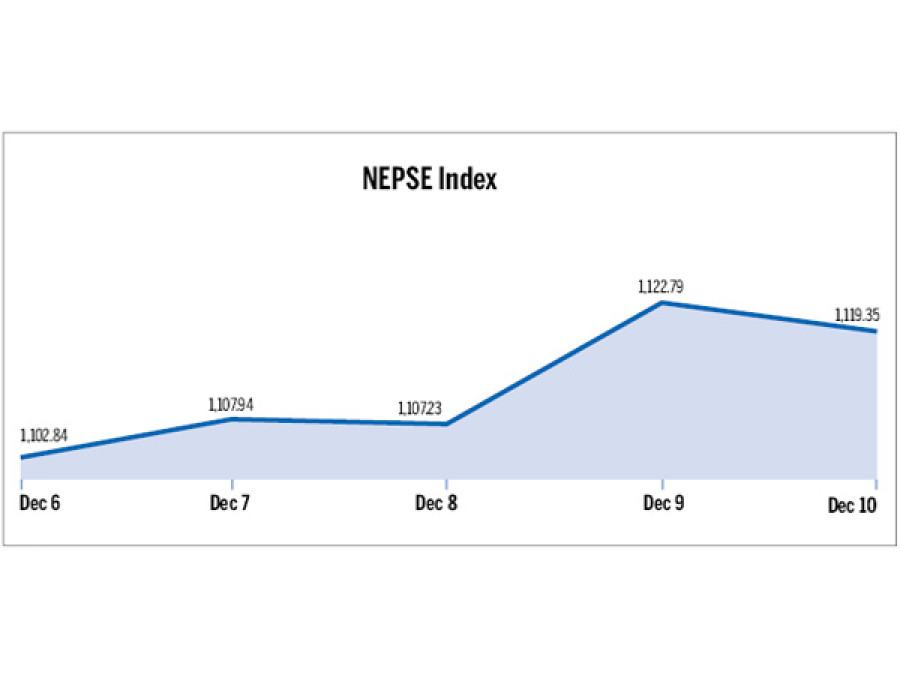

Nepse ends week 16.51 points up

Nepal Stock Exchange (Nepse) last week jumped 16.51 points to close at 1,119.35 points on Thursday.

Nepal Stock Exchange (Nepse) last week jumped 16.51 points to close at 1,119.35 points on Thursday.

The market that opened at 1,102.84 points on Sunday saw the week’s biggest single-day gain on Wednesday, when the benchmark index gained 15.56 points.

Sachin Silwal, managing director of Vision Securities attributed the rise in the market to a number of factors, including the possibility of India easing the trade embargo, dividend declaration by a number of companies and market correction.

“Amid expectations of a possible easing of India-imposed trade embargo, the buying pressure rose, pushing up the index and the transaction volume,” he said.

Of the nine trading groups, six posted gains. The Insurance Companies group (up 106.54 points) was the biggest gainer, followed by Development Banks, Finance Companies, Hotels, Hydropower Companies and Commercial Banks.

Silwal attributed the rise in the Insurance sub-index to

nearing book closure. “At a

time when almost all the commercial banks have declared

dividends, investors were attracted towards insurance shares,” he said.

The Others sub-index dropped 2.34 points, Manufacturing and Trading groups remained stable at 1,883.18 points and 207.97 points, respectively. The sensitive index that measures the performance of ‘A’ class companies also was up 3.13 points to close at 241.43 points.

The overall market transaction surged 27.50 percent to Rs1.86 billion, while the number of shares traded increased to 2,984,820 units from 2,863,030.

NIC Asia Bank posted the highest individual transaction of Rs142.21 million. It was followed by Nepal Life Insurance, Chhimek Laghubitta Bikas Bank, Bank of Kathmandu and Deprox Development Bank. With 219,000 units of its shares changing hands, Nabil Balance Fund 1 topped in terms of the number of shares traded.

Meanwhile, Nepse listed bonus shares of Country Development Bank and Siddhartha Insurance. It also registered 540,000 right shares of Prudential Insurance.