29.12°C Kathmandu

29.12°C KathmanduMoney

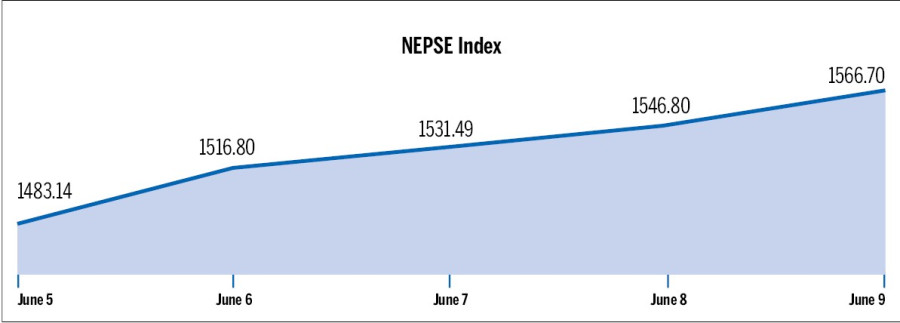

Insurers lead as Nepse up 83.56 pts

The insurance sector saw a whopping growth of 1,246.91 points last week amid expectations of a hike in paid-up capital requirements.

The insurance sector saw a whopping growth of 1,246.91 points last week amid expectations of a hike in paid-up capital requirements.

The surge has been attributed to new budgetary provisions on taxation favouring business growth of the insurance sector. However, stockbrokers said the unusual growth, largely based on future expectations of high returns, was not realistic.

“Investors might face losses if the insurance companies failed to secure growth as expectations are higher than the movement of indicators,” said Bhuwaneshwor Yadav, managing director of Agrawal Securities.

Out of nine trading groups, seven posted gains. Unlike the insurance sector, other six groups posted slight increment in their indices not exceeding 100 points. The hotel sector lost 106.47 points, while the trading group remained stable at 201.38 points.

Meanwhile, Nepal Stock Exchange (Nepse) closed at 1,566.70 points hitting a fresh all-time high last week. The market jumped 83.56 points over the week and saw highest ever single-day transaction of Rs1.89 billion on Thursday.

Stockbrokers attributed the rise to increasing demand and supply of shares. “The market has seen rapid transactions and many new investors after the introduction of the paperless share transaction system,” said Yadav.

Because of the growing absorption capacity of the market, the average daily transaction volume neared Rs1 billion from Rs400 million during January, before the enforcement of paperless transaction system.

The overall transaction volume increased 15.29 percent last week.

“The capital appreciation will be positive in the upcoming days if the debate on Bafia settles on a positive note along with an increase in supply,” said Priya Raj Regmi, president of stockbroker’s association of Nepal. “The two-fold increment in the transaction volume in a span of a few months is not unusual. Developed markets have also experienced such growths after adopting online transaction system.”

Nepal Bangladesh Bank led the charts in terms of the highest turnover (Rs794.1 million), number of transactions (2,669) and traded shares (1.21 million units). Eight companies—Shikar Insurance, Hama Merchant and Finance, Lumbini General Insurance, Oriental Hotels, Muktinath Bikas Bank, Kankai Bikas Bank, Triveni Bikas Bank and Infrastructure Development Bank—listed their bonus shares.

Sanima Bank 538.82

Nepal Life Insurance 441.55

Citizen Bank International 322.95

Himalayan General Insurance 233.55

Insurance 1246.91

Commercial Banks 56.76

Development Banks 59.29

Finance 20.6

Hydropower 56.72

Manufacturing 25.94

Others 12.92

Hotels -106.47

.jpg&w=200&height=120)

.jpg&w=300&height=200)