18.12°C Kathmandu

18.12°C KathmanduMoney

Nepse below 1,800 on profit booking

Of nine trading groups, indices of six posted decline. The manufacturing sector (down 117.23 points) was the biggest loser

Nepal Stock Exchange (Nepse) went below 1,800 points last week to hit a 26-day low as large investors rushed to book profits, resulting in a selling pressure.

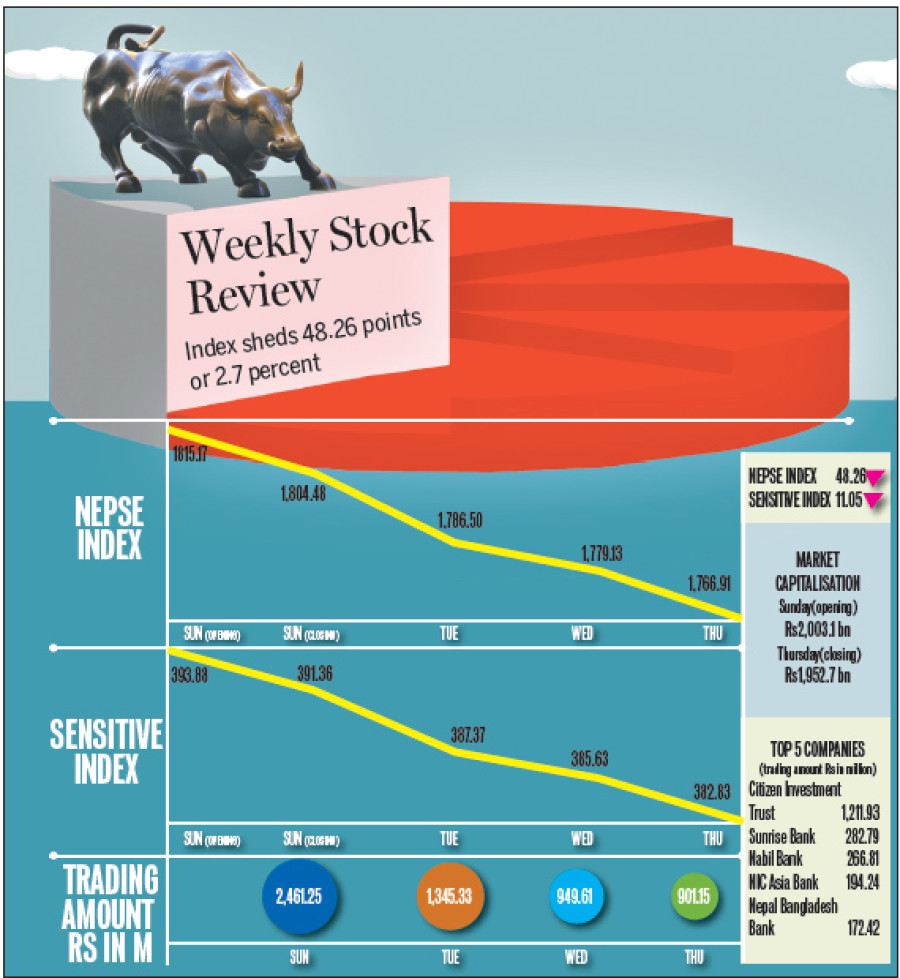

The index last week plunged 48.26 points (2.7 percent) to close at 1,766.91 points on Thursday, the last trading day of the week.

In four-day trading, the secondary market that opened at 1,815.17 points on Sunday shed 10.69 points to close at 1,804.48 points. On Tuesday, the market lost another 17.98 points to close at 1,786.50 points. The index dropped further 7.37 points to 1,779.13 points on Wednesday. Similarly on Thursday, the index dipped 12.22 points to settle the week at 1,766.91 points.

“As investors started to sell shares after getting dividends, it lead the market to a fall,” said Narendra Raj Sijapati, managing director of Kalika Securities.

The sensitive index that measures the performance of Group A companies also slipped 11.05 points to close at 382.83 points. With the drop in the Nepse index, the value of the stocks of listed companies fell by Rs50.43 billion as the market capitalisation dipped to Rs1,952.67 billion.

Of nine trading groups, indices of six posted decline. The manufacturing sector (down 117.23 points) was the biggest loser. Sijapati said the decline in the stock price of Unilever Nepal Limited after dividend announcement, dragged down the manufacturing sub-index. The sub-index of commercial banks, which account for more than 50 percent of the overall market capitalisation, saw a double-digit fall of 70.06 points.

Hydropower companies lost 28.56 points, while development banks and finance companies and insurance comapneis shed 25.06 points, 13.66 points and 79.76 points, respectively.

Of the two gainers, hotels rose 48.78 points to close at 2,260.51 points, while the others group gained 4.05 points to settle 8,983.37 points. The sub-index of trading group was stable at 202.79 points.

Last week, Citizen Investment Trust topped in terms of the transaction volume (Rs1.21 billion). “The huge turnover of Citizen Investment Trust was because its stocks held by Nepal Bank Limited were auctioned last week,” said Sijapati.

With a turnover of Rs282.79 million, Sunrise Bank stood second. Nabil Bank, NIC Asia Bank and Nepal Bangladesh Bank rounded out the top five companies in terms of the turnover amount.NIBL Sambriddha Fund 1 led in terms of the number of shares traded (863,000 units)

Last week, the shares of 152 companies were traded. Despite the fall in the Nepse index, the overall market turnover surged 50.84 percent to Rs5.65 billion, while the number of shares traded rose to 7,239,750 units from 6,417,540 units.