17.12°C Kathmandu

17.12°C KathmanduMoney

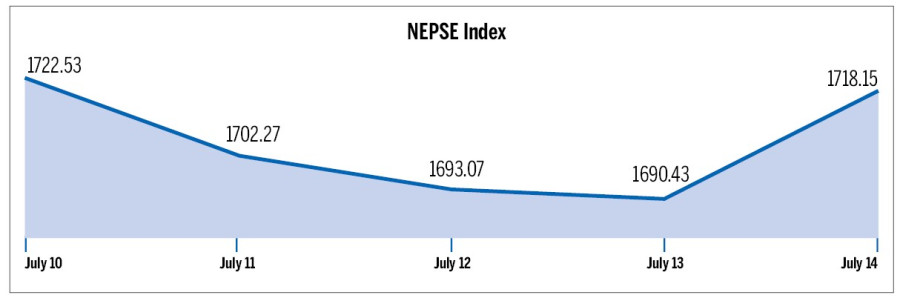

Nepse ends 4.38 points lower

Nepal Stock Exchange (Nepse) shed points in the first four trading days before making some recovery on the last day.

Political developments towards the government change resulted in a drop in the benchmark Nepse Index in the initial days, but expectations from the Monetary Policy presented on Thursday pushed the market up, according to stock analysts. The market lost 32.1 points in the first four days before recovering some losses in the last day. Nepse closed the week 4.38 points lower.

“Investors adopted a wait-watch-go approach amid political uncertainty after the CPN (Maoist-Centre) pulled out of the government,” said Nawaraj Subedi, managing director of Trishul Securities and Investment. “The growth in the overall index in the last trading day follows the previous trend as investors expect the companies to file good returns at the fiscal year end.”

The insurance shares in the recent days are subjected to portfolio divestment as investors shifted to finance and banking scrip amid expectations of a favourable monetary policy.

In line with that, the share prices of all 13 non-life insurance and seven life insurance companies have been falling for the past two weeks on an average of Rs190.69 and Rs236, respectively.

Moreover, the monetary policy released by the Nepal Rastra Bank (NRB) on Thursday is yet to influence the securities market. “The prices of shares of microfinance sector might fall on Sunday as an aftermath of the new provision of the seven-percent spread rate,” said Subedi.

Amid hefty dividends distributed by micro-finance institutions, their share prices had soared in recent months. “However, retail microfinance companies which infuse loans on a countrywide level have seen a favourable policy of a paid-up capital hike of Rs600 million. Such companies’ share prices are going to revive,” said Subedi.

Turnover at the secondary market, which had been observing a high volume of transactions of around Rs2 billion for a couple of months, has fallen in recent days to Rs1 billion as investors awaited favourable policy and national-level changes. Everest Bank posted the highest turnover of Rs 275.4 million, while Siddhartha Equity Oriented Scheme led in terms of the number of shares traded (1.2 million units). Total turnover last week increased by 0.78 percent to Rs6.4 billion.

The market also witnessed an addition of 4.7 million shares during the review period as Dev Development Bank, Gandaki Development Bank, Western Development Bank and Lumbini Bank (now Bank of Kathmandu Lumbini) listed their bonus shares.

TOP FIVE COMPANIES IN TERMS OF TURNOVER |

|

Company | Turnover (in Rs. millions) |

Everest Bank | 275.46 |

Janata Bank | 194.28 |

First Microfinance Dev Bank | 193.83 |

Taragaun Regency | 187.75 |

Hydropower Invest & Dev Co | 187.01 |

SECTORS THAT WENT UP |

|

Sector | Points Gained |

Manufacturing Sector | 124.16 |

Others | 35.29 |

Commercial Banks | 8.62 |

SECTORS THAT WENT DOWN |

|

Sector | Points Gained |

Insurance | 366.89 |

Development Bank | 35.37 |

Finance | 20.72 |

Hotel | 11.59 |

Hydropower | 9.96 |

.jpg&w=300&height=200)