17.12°C Kathmandu

17.12°C KathmanduMoney

Nepse slips on profit booking

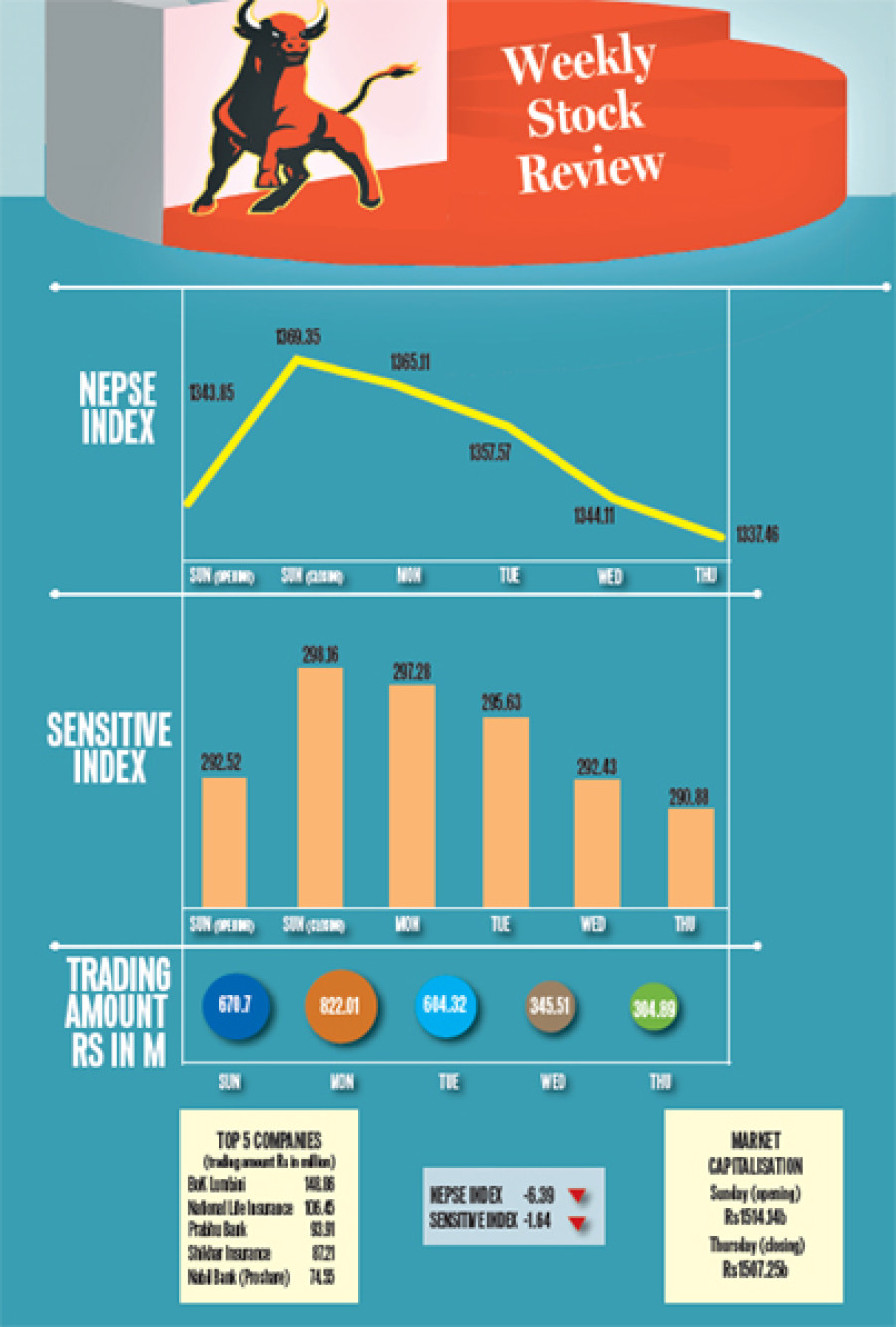

Nepal Stock Exchange (Nepse) last week lost 6.39 points to close at 1,337.46 points, as investors rushed to book profits amid rising prices.

Nepal Stock Exchange (Nepse) last week lost 6.39 points to close at 1,337.46 points, as investors rushed to book profits amid rising prices.

The market that opened at 1,343.85 points on Sunday rose 25.5 points to close the day at 1,369.35 points. However, it lost 4.24 points on Monday to reach 1,365.11 points. The losses continued for the following three days, with the index shedding 7.54 points, 13.46 points and 6.65 points, respectively.

Overall, the index declined closed the week 0.47 percent lower.

“As prices rose in the previous week, investors rushed to book short-term profits,” said Santosh Mainali, general-secretary of Stock Brokers’ Association of Nepal.

“Also, investors who had been expecting the Nepal Rastra Bank to revise its monetary policy to resolve liquidity crunch in the banking system were disappointed as the central bank failed to come up with a notable measure,” said Mainali.

Along with the Nepse, the sensitive index that measures the performance of Group ‘A’ companies also slipped 1.64 points to 290.88 points. The total value of shares listed on the exchange fell by Rs6.89 billion, with the market capitalisation reaching Rs1,507.25 from Rs1,514.14 billion over the week.

Of the nine trading groups, hotels saw the largest loss of 30.52 points to close at 1,705.81 points. “As this sub-group has lower number of shares on the market, small fluctuation in demand/supply brings a large change in the index,” Mainali said.

Commercial bank stood second, with the sub-index declining by 19.13 points to close at 1,273.45 points. Hydropower and manufacturing groups saw their indices

fall 14.7 points and 5.98 points, respectively.

The insurance sub-index led the gainers’ side, witnessing a rise of 45.49 points. Development banks gained 15.94 points, while others and finance companies were up 15.04 points and 0.02 points, respectively. The trading group was non-mover at 206.16 points.

Bank of Kathmandu Lumbini posted the largest transaction of Rs148.86 million. According to Mainali, the bank’s announcement of 23 percent bonus shares and further public offering attracted investors. National Life Insurance came second with Rs106.45 million turnover, followed by Prabhu Bank, Shikhar Insurance and Nabil

Bank promoter’s shares. NIBL Sambriddhi Fund 1 took the pole position in terms of the number of shares traded (384,000 units).

Last week, shares of 161 listed companies were traded. Despite the fall in the Nepse index, the transaction amount went up 6.43 percent to Rs2.74 billion. But the number of shares traded dropped to 6,234,350 units from 7,907,720 units.

Right Shares/Bonus Shares

Company Type Units

ShiCompany Types of Shares Units

Everest Finance Bonus 199,403

Lumbini General Insurance Bonus 600,000

Mirmire Microfinance Development Bank Bonus 100,000

Sahara Bikas Bank Bonus 82,600

Muktinath Bikas Bank Bonus 2,850,671.35

Muktinath Bikas Bank Right 4,192,163.75

Araniko Development Bank Right 928,190.34

Sahara Bikas Bank Right 354,000

.jpg&w=300&height=200)