28.12°C Kathmandu

28.12°C KathmanduMoney

Budget 2017-18

The government on Monday launched budget of Rs1,279 billion for the next fiscal year.

The government on Monday launched budget of Rs1,279 billion for the next fiscal year. Of this fund, Rs803.5 billion has been earmarked for recurrent expenditure, Rs335.2 billion for capital expenditure and Rs140.3 billion for financing provision.

Highlights of the 2017-18 budget

Allocation (Rs in billion)

2013-14 2014-15 2015-16 2016-17 2017-18

Budget 517.24 618.1 819.47 1048.92 1278.99

Recurrent Expenditure 353.42 398.95 484.27 617.16 803.53

Capital Expenditure 85.1 116.75 208.88 311.95 335.17

Financing Provision 78.72 102.39 126.32 119.81 140.29

SOURCES OF FUNDS 2013-14 2014-15 2015-16 2016-17 2017-18

Revenue Target 354.5 422.9 475.01 565.9 730.1 Principal Repayment 5.5 1 2 10 15

Foreign Grants 69.54 73.38 110.93 106.9 72.17

Foreign Loans 43.7 49.52 94.96 195.71 214.04

Domestic Loans 44 52.75 88 111 145

Carryover 0 0 48.56 59.41 102.74

517.24 599.55 819.46 1048.92 1279.05

Foreign Grants and Loans (Rs in billion)

2013-14 2014-15 2015-16 2016-17 2017-18

Foreign grant+loans

(Rs in billion) 113.24 122.9 205.89 302.61 286.21

Share of grants and

loans in budget 21.89 19.88 25.12 28.85 22.38

Where is the money going (Rs in billion)

General Public Services 499.15

Defence 44.96

Public Order and Safety 50.63

Economic Affairs 454.60

Environmental Protection 15.14

Housing and Community Amenities 63.06

Health 41.09

Recreation, Culture & Religion 5.97

Education 65.14

Social Security 39.26

1279.00

How is recurrent budget being utilised (Rs in billion)

Salaries/benefits 130.53

Use of equipment and services 120.05

Interest and service cost 30.8

Assistance 1.02

Grants 184.74

Social security 102.64

Other expenses 1.56

Fiscal Transfer 232.2

How is capital budget being utilised (Rs in billion)

Land 21.55

Building 75.66

Furniture 1.51

Vehicles 3.88

Machinery equipment 11.78

Civil works 200.6

Research & Consultancy 16.41

Capital Contingency 3.78

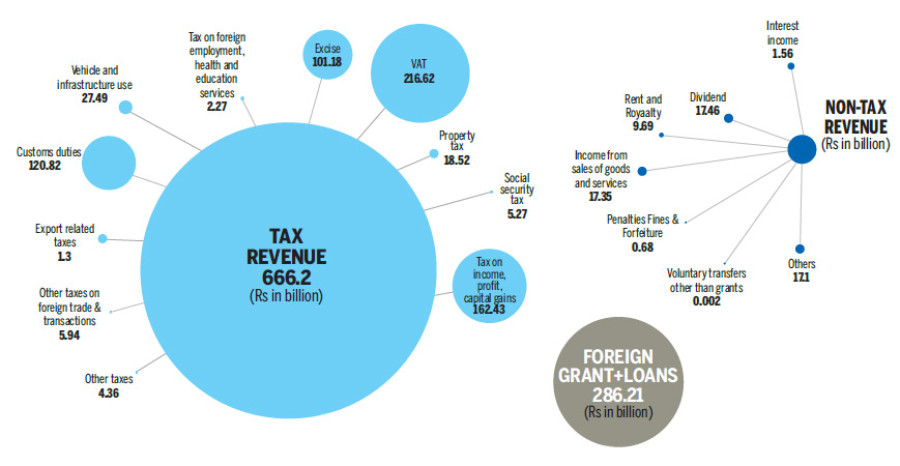

Tax Revenue (Rs in billion)

Tax on income, profit, capital gains 162.43

Social security tax 5.27

Property tax 18.52

VAT 216.62

Excise 101.18

Tax on foreign employment, health

and education services 2.27

Vehicle and infrastructure use 27.49

Customs duties 120.82

Export related taxes 1.3

Other taxes on foreign trade & transactions 5.94

Other taxes 4.36

.jpg&w=300&height=200)