30.12°C Kathmandu

30.12°C KathmanduMoney

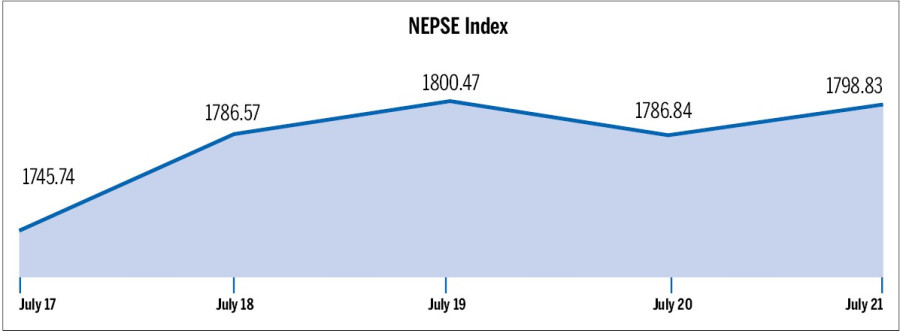

Stock market jumps 53.09 points

Nepal Stock Exchange (Nepse) last week jumped 53.09 points amid expectations of good dividend declaration by commercial banks and paid-up capital hike of insurance companies.

Nepal Stock Exchange (Nepse) last week jumped 53.09 points amid expectations of good dividend declaration by commercial banks and paid-up capital hike of insurance companies.

Investors, who previously focused on trading micro-finance institutions (MFIs) shares, turned back to banks and insurance shares after the monetary policy lowered the profit potential of MFIs with the provision of 7 percent interest rate spread.

“The market in recent days has been backed up by financial reports of commercial banks as they have earned good profits,” said Prakash Tiwari, financial analyst at Hathway Investment Nepal. “Dividend declaration in the upcoming weeks will further induce positive movements and transactions of banking scrip will rise accordingly.”

With the end of the last fiscal year 2015-16, the banks have started publishing their fourth quarter financial reports.

According to Tiwari, potential paid-up capital hike of insurance companies will push up the prices in the upcoming days, if expectations materialise. As the investors making big investment in MFIs shifted to banking and insurance sectors, there were massive demand for banking and insurance shares, according to the brokers.

With the monetary policy not adopting any provision for hiking paid-up capital requirements for MFIs while also imposing spread rate, the investors were forced to go for alternatives.

Meanwhile, the transaction volume surged 50 percent during the week as the market recorded Rs2.14 billion single-day transaction on Tuesday. The transaction volume increased from Rs6.4 billion to Rs9.3 billion over the week. Out of the nine trading

groups, six posted gains. The hydropower and others sectors observed fall in their indices, while the insurance and manufacturing led the gainers’ side.

However, the market was dominated by commercial banks in terms of volume and the number of transactions. Share prices of Machhapuchre Bank rose to Rs870 from Rs748, while Siddhartha Bank also observed an increase of Rs275 in its share price over the week.

Other banks also saw rising share prices as the market was largely driven by expectations of high capital gains in the banking sector. Siddhartha Bank posted the highest turnover of Rs565.39 million followed by Machhapuchre with Rs548.77 million and Nepal Bank with Rs405.89 million.

.jpg&w=300&height=200)